OVERVIEW

These terms of service, together with any documents and additional terms they expressly incorporate by reference (collectively, these “Terms”), are entered into between Durbull SpA. (“Durbull,” “we,” “us” and “our”) and you or the company or other legal entity you represent (“you” or “your”), and constitute a binding legal agreement. Please read these Terms carefully, as these Terms govern your use of our Portal and our Services, and expressly cover your rights and obligations, and our disclaimers and limitations of legal liability, relating to such use. By accessing or using our Portal or our Services, you accept and agree to be bound by and to comply with these Terms, including the mandatory arbitration provision in Section 12. If you do not agree to these Terms, you must not access or use our Portal or the Services.

You must be able to form a legally binding contract online either on behalf of a company or as an individual. Accordingly, you represent that: (a) if you are agreeing to these Terms on behalf of a company or other legal entity, you have the legal authority to bind the company or other legal entity to these Terms; and (b) you are at least 18 years old (or the age of majority where you reside, whichever is older), can form a legally binding contract online, and have the full, right, power and authority to enter into and to comply with the obligations under these Terms.

Please carefully review the disclosures and disclaimers set forth in Section 9 in their entirety before using any software developed by Durbull. The information in Section 9 provides important details about the legal obligations associated with your use of the Durbull open-source software. By accessing or using our Portal or our Services, you agree that Durbull does not provide execution or clearing services of any kind and is not responsible for the execution or clearing of transactions automated through Durbull's open-source software.

- KEY DEFINITIONS

For the purpose of these Terms, the following capitalized terms shall have the following meanings:

1.1 “Affiliate” means, with respect to a party to these Terms, any legal entity that, directly or indirectly controls, is controlled by or is under common control with such party. “Applicable Law” means any domestic or foreign law, rule, statute, regulation, by-law, order, protocol, code, decree, or another directive, requirement, or guideline, published or in force that applies to or is otherwise intended to govern or regulate any person, property, transaction, activity, event or other matter, including any rule, order, judgment, directive or other requirement or guideline issued by any Governmental Authority having jurisdiction over Durbull, you, the Portal or the Services, or as otherwise duly enacted, enforceable by law, the common law or equity.

1.2 “AVAX” means the Avalanche Blockchain utility token that may be used to purchase computational resources to run decentralized applications or perform actions on the Avalanche Blockchain.

1.3 “Avalanche Address” means the unique public key cryptocurrency identifier that points to an Avalanche-compatible wallet to which AVAX may be sent or stored.

1.4 “Avalanche Blockchain” means the underlying blockchain infrastructure which the Portal leverages to perform portions of the Services.

1.5 “Governmental Authority” includes any domestic or foreign federal, provincial or state, municipal, local or other governmental, regulatory, judicial, or administrative authority.

1.6 “Portal” means the Durbull site located at durbull.com, and all associated sites linked thereto by Durbull and its Affiliates, which includes, for certainty, Durbull’s decentralized application layer on the Avalanche Blockchain.

1.7 “Services” has the meaning set out in Section 3.1.

- MODIFICATIONS TO THESE TERMS

We reserve the right, in our sole discretion, to modify these Terms from time to time. If we make changes, we will provide you with notice of such changes, such as by sending an email, providing a notice through our Services, or updating the date at the top of these Terms. Unless we say otherwise in our notice, any and all such modifications are effective immediately, and your continued use of our Services after we provide such notice will confirm your acceptance of the changes. If you do not agree to the amended Terms, you must stop using our Services.

- SERVICES

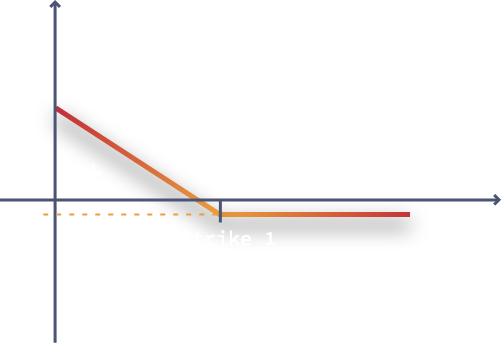

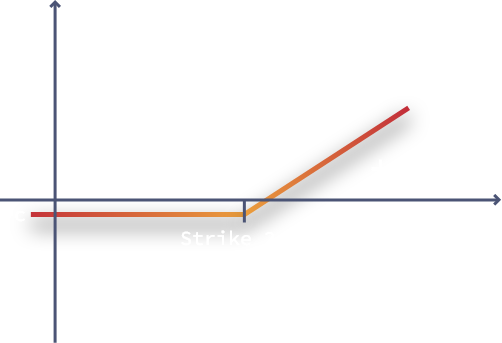

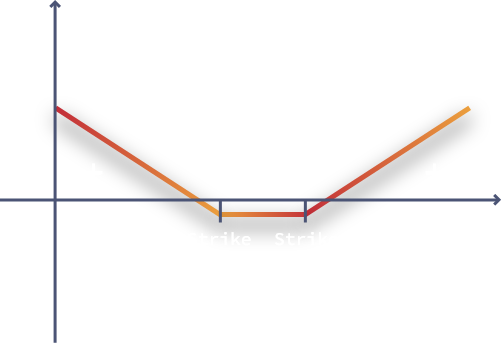

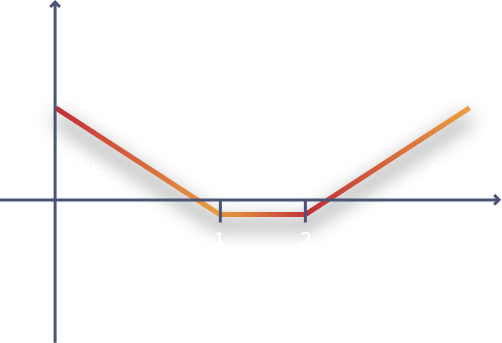

3.1 Services - The primary purpose of the Portal is to enable users to interact with smart contracts and hedge against risk or gain exposure to risk via the option positions (the “Services”).

3.2 Avalanche Gas Charges - Some Services involve the use of the Avalanche Blockchain, which may require that you pay a fee, commonly known as “Avalanche Gas Charges,” for the computational resources required to perform a transaction on the Avalanche Blockchain. You acknowledge and agree that Durbull has no control over (a) any Avalanche Blockchain transactions; (b) the method of payment of any Avalanche Gas Charges; or (c) any actual payments of Avalanche Gas Charges. Accordingly, you must ensure that you have a sufficient balance of AVAX stored at your Avalanche Address to complete any transaction on the Avalanche Blockchain before initiating such Avalanche Blockchain transaction. We will make reasonable efforts to notify you of any Avalanche Gas Charges before initiating any Services that require the use of the Avalanche Blockchain.

3.3 Conditions and Restrictions - We may, at any time and in our sole discretion, restrict your access to, or otherwise impose conditions or restrictions upon your use of, the Services or the Portal, with or without prior notice.

3.4 No Broker, Legal or Fiduciary Relationship - Durbull is not your broker, lawyer, intermediary, agent, or advisor and has no fiduciary relationship or obligation to you regarding any other decisions or activities that you effect when using the Portal or the Services. Neither our communications nor any information that we provide to you is intended as or shall be considered or construed as, advice.

3.5 Your Responsibilities - As a condition to accessing or using the Services or the Portal, you shall: (a) only use the Services and the Portal for lawful purposes and in accordance with these Terms; (b) ensure that, at all times, all information that you provide on the Portal is current, complete and accurate; and (c) maintain the security and confidentiality of your Avalanche Address.

3.6 Unacceptable Use or Conduct - As a condition to accessing or using the Portal or the Services, you will not: (a) violate any Applicable Law, including, without limitation, any relevant and applicable anti-money laundering and anti-terrorist financing laws, such as the Bank Secrecy Act, each as may be amended; (b) infringe on or misappropriate any contract, intellectual property or other third-party right, or commit a tort while using the Portal or the Services; (c) use the Services in any manner that could interfere with, disrupt, negatively affect, or inhibit other users from fully enjoying the Services, or that could damage, disable, overburden, or impair the functioning of the Services in any manner; (d) attempt to circumvent any content filtering techniques or security measures that Durbull employs on the Portal, or attempt to access any service or area of the Portal or the Services that you are not authorized to access; (e) use the Services to pay for, support, or otherwise engage in any illegal gambling activities, fraud, money-laundering, or terrorist activities, or other illegal activities; (f) use any robot, spider, crawler, scraper, or other automated means or interface not provided by us, to access the Services or to extract data; (g) introduce any malware, virus, Trojan horse, worm, logic bomb, drop-dead device, backdoor, shutdown mechanism or other harmful material into the Portal or the Services; (h) provide false, inaccurate, or misleading information; (i) post content or communications on the Portal that are, in our sole discretion, libelous, defamatory, profane, obscene, pornographic, sexually explicit, indecent, lewd, vulgar, suggestive, harassing, hateful, threatening, offensive, discriminatory, bigoted, abusive, inflammatory, fraudulent, deceptive or otherwise objectionable; (j) post content on the Portal containing unsolicited promotions, political campaigning, or commercial messages or any chain messages or user content designed to deceive or trick the user of the Service; (k) use the Portal or the Services from a jurisdiction that we have, in our sole discretion, or a relevant Governmental Authority has determined is a jurisdiction where the use of the Portal or the Services is prohibited; or (l) encourage or induce any third party to engage in any of the activities prohibited under this Section 3.7.

3.7 Your Assumption of Risks - You represent and warrant that you: (a) have the necessary technical expertise and ability to review and evaluate the security, integrity, and operation of any option position; (b) have the knowledge, experience, understanding, professional advice and information to make your own evaluation of the merits, risks and applicable compliance requirements under Applicable Law of any option position; (c) know, understand and accept the risks associated with your Avalanche Address, the Avalanche Blockchain, AVAX and option Positions; and (d) accept the risks associated with option Positions, and are responsible for conducting your own independent analysis of the risks specific to any option Positions. You hereby assume, and agree that Durbull will have no responsibility or liability for, such risks. You hereby irrevocably waive, release and discharge all claims, whether known or unknown to you, against Durbull, its affiliates, and their respective shareholders, members, directors, officers, employees, agents, and representatives related to any of the risks set forth herein.

3.8 - Your Content - You hereby grant to us a royalty-free, fully paid-up, sublicensable, transferable, perpetual, irrevocable, non-exclusive, worldwide license to use, copy, modify, create derivative works of, display, perform, publish and distribute, in any form, medium or manner, any content that is available to other users via the Durbull Platform as a result of your use of the Portal (collectively, “Your Content”) through your use of the Services or the Portal, including, without limitation, for promoting Durbull (or its Affiliates), the Services or the Portal. You represent and warrant that: (a) you own Your Content or have the right to grant the rights and licenses in these Terms; and (b) Your Content and our use of Your Content, as licensed herein, does not and will not violate, misappropriate or infringe on any third party’s rights.

- PRIVACY

Please refer to our privacy policy available at durbull.com for information about how we collect, use, share and otherwise process information about you.

- PROPRIETARY RIGHTS

5.1 - Ownership of Services; License to Services Excluding any open source software (as further described in Section 5.2) or third-party software that the Portal or the Services incorporates, as, between you and Durbull, Durbull owns the Portal and the Services, including all technology, content and other materials used, displayed or provided on the Portal or in connection with the Services (including all intellectual property rights subsisting therein), and hereby grants you a limited, revocable, transferable, license to access and use those portions of the Portal and the Services that are proprietary to Durbull.

5.2 - Trademarks Any of Durbull’s product or service names, logos, and other marks used in the Portal or as a part of the Services, including Durbull's name and logo are trademarks owned by Durbull, its Affiliates, or its applicable licensors. You may not copy, imitate, or use them without Durbull’s (or the applicable licensor’s) prior written consent.

- CHANGES; SUSPENSION; TERMINATION

6.1 - Changes to Services We may, at our sole discretion, from time to time and with or without prior notice to you, modify, suspend or disable, temporarily or permanently, the Services, in whole or in part, for any reason whatsoever, including, but not limited to, as a result of a security incident.

6.2 - No Liability We will not be liable for any losses suffered by you resulting from any modification to any Services or from any suspension or termination, for any reason, of your access to all or any portion of the Portal or the Services.

6.3 - Survival The following sections will survive any termination of your access to the Portal or the Services, regardless of the reasons for its expiration or termination, in addition to any other provision which by law or by its nature should survive: Sections 1, 4, 5, 6.3, and 7-14.

- ELECTRONIC NOTICES

You consent to receive all communications, agreements, documents, receipts, notices, and disclosures electronically (collectively, our “Communications”) that we provide in connection with these Terms or any Services. You agree that we may provide our Communications to you by posting them on the Portal or by emailing them to you at the email address you provide in connection with using the Services if any. You should maintain copies of our Communications by printing a paper copy or saving an electronic copy. You may also contact our support team to request additional electronic copies of our Communications by filing a support request at support@durbull.com.

- INDEMNIFICATION

You will defend, indemnify, and hold harmless us, our Affiliates, and our and our Affiliates’ respective shareholders, members, directors, officers, employees, attorneys, agents, representatives, suppliers, and contractors (collectively, “Indemnified Parties”) from any claim, demand, lawsuit, action, proceeding, investigation, liability, damage, loss, cost or expense, including without limitation reasonable attorneys’ fees, arising out of or relating to (a) your use of, or conduct in connection with, the Portal; (b) Avalanche Blockchain Tokens associated with your Avalanche Address; (c) any feedback or user content you provide to the Portal if any; (d) your violation of these Terms; or (e) your infringement or misappropriation of the rights of any other person or entity. If you are obligated to indemnify any Indemnified Party, Durbull (or, at its discretion, the applicable Indemnified Party) will have the right, in its sole discretion, to control any action or proceeding and to determine whether Durbull wishes to settle, and if so, on what terms.

- DISCLOSURES; DISCLAIMERS

Durbull is a developer of open-source software. Durbull does not operate a virtual currency or derivatives exchange platform or offer trade execution or clearing services and therefore has no oversight, involvement, or control with respect to your transactions. All transactions between users of Durbull open-source software are executed peer-to-peer directly between the users’ digital wallets through a smart contract.

As a user of Durbull, you declare that you are not a citizen or resident of any jurisdiction in which either the use of any of the Services, exchange, purchase, receipt, or holding of any Tokens is prohibited, restricted, curtailed, hindered, impaired or otherwise adversely affected by any Applicable Laws;

- EXCLUSION OF CONSEQUENTIAL AND RELATED DAMAGES

In no event shall we (together with our Affiliates, including our and our Affiliates’ respective shareholders, members, directors, officers, employees, attorneys, agents, representatives, suppliers or contractors) be liable for any incidental, indirect, special, punitive, consequential or similar damages or liabilities whatsoever (including, without limitation, damages for loss of data, information, revenue, goodwill, profits or other business or financial benefit) arising out of or in connection with the Portal and the Services (and any of their content and functionality), any execution or settlement of a transaction, any performance or non-performance of the Services, your AVAX, option Positions or any other product, service or other item provided by or on behalf of us, whether under contract, tort (including negligence), civil liability, statute, strict liability, breach of warranties, or under any other theory of liability, and whether or not we have been advised of, knew of or should have known of the possibility of such damages and notwithstanding any failure of the essential purpose of these Terms or any limited remedy hereunder nor is Durbull in any way responsible for the execution or settlement of transactions between users of Durbull open-source software.

- LIMITATION OF LIABILITY

In no event shall we (together with our Affiliates, including our and our Affiliates’ respective shareholders, members, directors, officers, employees, attorneys, agents, representatives, suppliers or contractors) be liable for any incidental, indirect, special, punitive, consequential or similar damages or liabilities whatsoever (including, without limitation, damages for loss of data, information, revenue, goodwill, profits or other business or financial benefit) arising out of or in connection with the Portal and the Services (and any of their content and functionality), any execution or settlement of a transaction, any performance or non-performance of the Services, your AVAX, option Positions or any other product, service or other item provided by or on behalf of us, whether under contract, tort (including negligence), civil liability, statute, strict liability, breach of warranties, or under any other theory of liability, and whether or not we have been advised of, knew of or should have known of the possibility of such damages and notwithstanding any failure of the essential purpose of these Terms or any limited remedy hereunder nor is Durbull in any way responsible for the execution or settlement of transactions between users of Durbull open-source software.

- GOVERNING LAW AND DISPUTE RESOLUTION

These Terms shall be governed by and construed in accordance with, the laws of the Republic of Chile.

Any dispute arising out of or in connection with these Terms, including any question regarding its existence, validity, or termination, shall be referred to and finally be resolved by arbitration in Chile in accordance with the rules of the Chilean Arbitration Center for the time being in force, which rules are deemed to be incorporated by reference in this paragraph. The seat of the arbitration shall be Chile. The tribunal shall consist of a sole arbitrator to be appointed by the Chairman of the Arbitration Center. The language of the arbitration shall be Spanish. This arbitration agreement shall be governed by the laws of the Republic of Chile.

Each of the Parties irrevocably submits to the non-exclusive jurisdiction of the courts of Chile to support and assist the arbitration process.